|

|

|

|

|

|

|

|

|

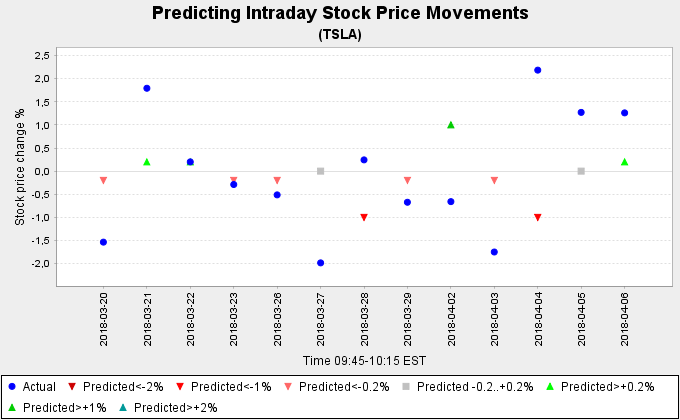

The goal here is to "predict" stock price movements within the thirty minute period after fifteen minutes from the market opening.

Multivariate analysisAmong technical indicators (opening and closing prices at specific points and volume. Source:Alpha Vantage) and values calculated based on those indicators per stock and per sector, there are several variables obtained from the same day's business news (Yahoo RSS feeds) with the help of syntactic/semantic parser before the market opening. The extracted information includes data from categories such as acquisitions, investments, cooperations, nominations and management actions (virtually, could be anything that might have any impact). While this set was run, only very few rules were defined to extract such information and this only had data from three months collected. The data was fed into deeplearning4j neural network model and handled as classification predicting the percentual movement range. The above image is one example of the stocks being evaluated and represents results better than the average, even though it has a couple of completely wrong guesses.

|